Disclosure: Yeah, these are affiliate links. If that offends you, fine – but I thought we were friends.

Why Round-Up Apps Even Matter

The best round-up apps 2025 are here to do one thing: save your lazy ass from yourself. Saving money sucks. Nobody dreams of stacking coins in a jar like some medieval peasant. Round-up apps steal your spare change automatically and either save it or throw it at your debt while you’re busy pretending to budget.

Shiny Version: It’s “effortless saving” — you keep spending like normal, but your money secretly works for you.

Bloody Version: It’s psychological trickery because humans are too lazy to transfer ten bucks themselves. But if manipulation works, why not embrace it?

And let’s be real — without automation, most people wouldn’t save a single damn dollar. That’s why these apps exist: because left to your own devices, you’d spend every cent on takeout, craft beer, or some subscription you forgot to cancel. At least this way, the algorithm cleans up your mess while you scroll TikTok.

Before downloading anything, check if your current bank already offers a round-up savings option. If it does, congrats — you just saved storage space and proved you can read fine print for once.

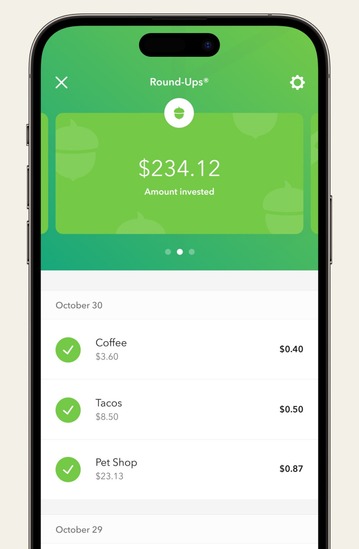

1. Acorns – Classic Round-Up Investing App

Shiny Version: Every purchase turns you into an investor — your spare change flows into ETFs while you sip lattes. One day, you’ll check the app and feel like a mini-Warren Buffett.

Bloody Version: Fees suck when your balance is tiny, and no, $3.47 invested in Apple won’t retire you. But hey, at least you didn’t blow it all on chips and beer.

Works globally, still one of the best round-up apps 2025 if you want to pretend you’re investing.

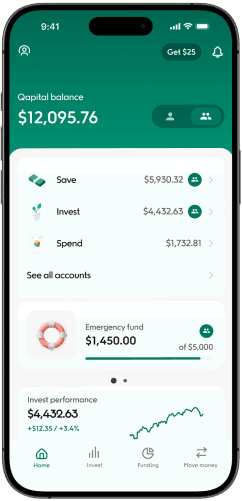

2. Qapital – Rules + Round-Up Savings App

Shiny Version: Turn saving into a game — round-ups, custom rules, even saving when you hit your step goals. It feels like money just falls into place.

Bloody Version: You’ll waste time setting goofy rules and patting yourself on the back, but at least the app saves while you’re busy pretending to hustle.

If you need an app to trick you into saving, maybe stop calling yourself disciplined.

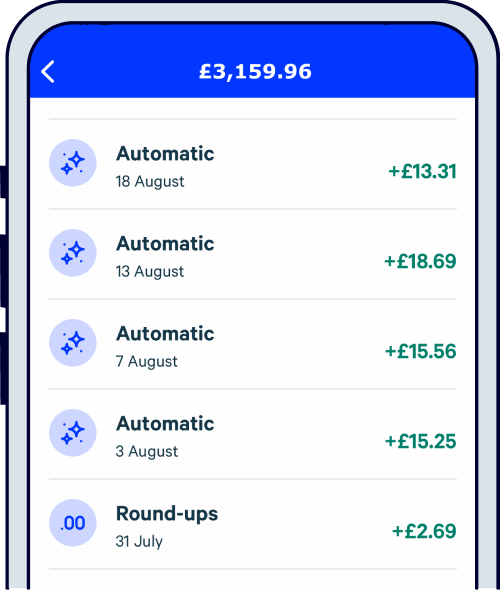

3. Plum (UK) – AI Round-Up Savings App

Shiny Version: An AI-powered app that analyzes your spending, rounds up your transactions, and squirrels away extra cash without you noticing.

Bloody Version: If you need an algorithm to save money for you, congratulations — you’ve officially outsourced common sense.

Perfect for UK users who want an excuse to stop blowing spare change on Deliveroo.

4. Moneybox (UK) – Round-Up App for Investing

Shiny Version: Round-ups go straight into savings or investments — from simple cash accounts to stocks and funds. It makes growing money look stupidly easy.

Bloody Version: Boring, safe, sensible. Which is probably exactly what you need if your idea of investing is still buying lottery tickets.

Great for UK users looking for one of the top round-up savings apps 2025.

5. Raiz (Australia) – Micro-Investing Round-Up App

Shiny Version: Formerly Acorns AU, Raiz turns round-ups into micro-investments. Plus, it adds cashback rewards and even lets you invest for your kids.

Bloody Version: It’s only helpful if you actually live in Australia. If you don’t, downloading this is about as useful as buying sunscreen in the Arctic.

For Aussies, though, it’s one of the best apps that round up purchases.

BloodyFinance Take

Round-up apps won’t make you rich. They won’t get you a yacht, or a Lambo, or even a smug post on LinkedIn. But they will stop you from being the clown who never saves a dime. If a robot has to outsmart your lazy habits — good. Let it.

Keep reading, keep growing. BloodyFinance.